To all ESPS and UPP members: Cost of retirement up by thousands

New figures show that the cost of retirement has risen by up to £9,100 a year, depending on the type of lifestyle you want when you stop work.

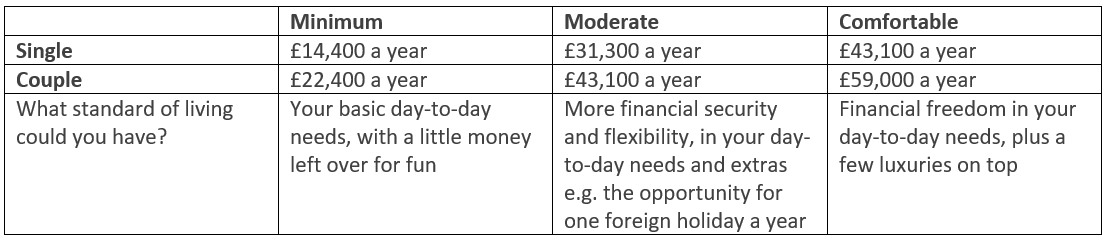

The Retirement Living Standards (RLS), created by the Pensions and Lifetime Savings Association (PLSA) and Loughborough University, estimate how much you might need in retirement each year, based on 3 different standards of living – minimum, moderate and comfortable.

According to the latest figures, costs have increased across all 3 levels for the second year in a row, with rises of up to 34%.

This means to enjoy a moderate standard of living in retirement, a single person will now need £31,300 a year, that’s £8,000 more than suggested last year. While a couple living a moderate lifestyle will need an extra £9,100, with an annual income of £43,100.

Slightly smaller increases were suggested in the other lifestyle categories, but still represented a rise of 12% for those wanting even the minimum standard of living when they stop work.

The latest RLS figures are shown below, along with some suggestions on what you can do if you’re worried you won’t be able to afford the lifestyle you want.

Costs are higher in London and can be found in full at retirementlivingstandards.org.uk

Why have the Retirement Living Standards increased?

The RLS are reviewed regularly and updated to reflect rising prices, and the public’s expectations of what retired people will need, not just to survive, but to “live with dignity” in their life after work.

The PLSA say that rising prices of domestic fuel and energy costs are the most significant factor in increasing what is needed this year.

Other factors include the soaring prices of:

- Food and groceries

- Social and cultural participation, such as spending time with family and friends out of the home

- Motoring costs

Using the Retirement Living Standards and reaching your savings goal*

Research has shown that having something to aim for makes it more likely you will reach your goal. You could use the Retirement Living Standards as a general guide to how much you might need when you stop work, and to help you set a savings target for your retirement.

For a more personalised estimate of your retirement costs, you can also use the Lifestyle Calculator Tool. It’s based on the RLS, but you can adjust certain figures for a more tailored idea of how much you might need, to pay for the retirement you hope for.

Work out if your pension adds up

To work out whether you’re on track to afford the retirement you hope for, you’ll need to compare your likely spend with the amount of income you’re likely to get.

If you’re an ESPS member you can see what the income might be from your Uniper pension by requesting an estimate in your online myESPS account.

If you’re a UPP member, please contact the administrator, Fidelity, on 0800 368 6868 or email: pensions.service@fil.com.

If your forecasted pension figures don’t match up to what you’re aiming for, don’t worry. There are steps you can take to improve your expected retirement income. This includes:

- Topping up your pension, if you’re an active member and can afford to do so. This is also known as making Additional Voluntary Contributions (AVCs), and it’s tax-free up to certain limits.

If you’re an active ESPS member you can find out more about AVCs here https://ukpensions.uniper.energy/esps/active/boosting-benefits

And if you’re a UPP member you read more about AVCs here - https://ukpensions.uniper.energy/upp/active/boosting-benefits

- Thinking about your broader financial circumstances, and looking at your retirement income in the round. This includes:

- Thinking about any other pension arrangements, or other sources of income you mayhave. For example, you could think about when you might be able to take your State Pension. You can check your State Pension age (SPA) here.

- Thinking about whether there are things you can do now, while you’re working to reduce your outgoings.

- Thinking about when you plan to retire, and whether you could consider working for longer.

Get help from a financial expert or adviser

Pensions can be confusing. If you’re thinking about making changes to your pension, or taking your retirement benefits, it’s a good idea to take financial advice. You can find a list of Independent Financial Advisers (IFAs) at unbiased.co.uk.

*Figures from The Retirement Living Standards (RLS) and Lifestyle Calculator Tool are based on the income you may need after tax.